Buying your first car is always a special feeling, but it is not always hunky-dory to get it financed by a bank. It is a tedious process to get your loan approved and take your family out for a ride in your dream car.

There are multiple checks and balances at play when it comes to sanctioning a loan to a borrower. Lenders assess many measures, prominent of them being borrower’s credit score, which gives information about his repayment history. Additionally, interest rates vary, collateral requirements are there, and you have to submit various documents, including income proof, to make them trust you.

Even after all this, lenders may reject your loan application if your credit score is below their acceptable standards. Repeated rejection of loan application by mainstream lenders further exacerbates your credit score.

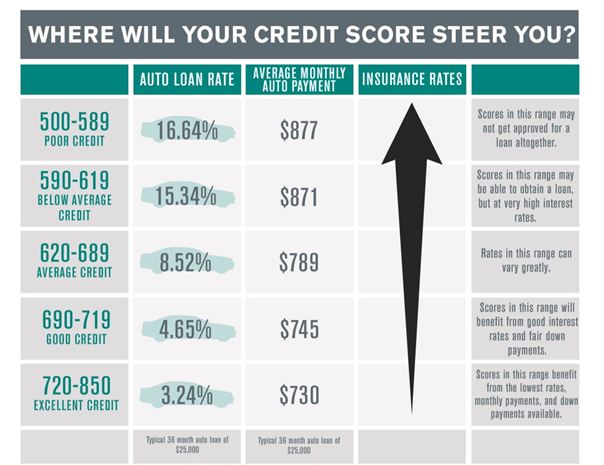

If you want to get your credit score report, then prefer reputed credit bureaus like TransUnion, Crediva, Experian, or Equifax. In a nutshell, the formalities and paperwork are on several levels to have proof of your creditworthiness. The picture below explains the ramifications of falling in the category of subprime borrowers.

Ride your favourite car despite a substandard credit profile!

Now, what if we tell you that you can get a car loan even if your credit score is low and that too, with minimal paperwork. There are options out there if you are planning to avail the options of car finance with bad credit but on instant decision.

There are many subprime lenders in the likes of peer-to-peer (P2P) lenders, NBFCs, Cooperative Banks who offer loans by not emphasising much on your credit score. However, the business model of online subprime lenders like Safe Money Loans revolves around catering specifically to such borrowers having a poor credit score.

You have two options here:

- Either improve your credit score to at least 700; or

- Start your research about the lenders offering loans despite poor credit history

The latter is a prudent option which serves your purpose that too in lesser time.

Choose the ideal lender for you. Here’s How

Now to exercise this option, you should start your research both online and offline to look for such lenders who are offering poor credit car finance.

The online method allows you to fill an online application on the lender’s website and offline method demands a physical visit to their office. There are institutions known for their instant decision of car finance despite low credit history of borrowers.

- Read extensively about their terms and conditions and note the interest rates they are offering.

- The next step is to approach the online lender for vehicle finance if its interest rate and other loan policies are suitable for you.

One word of caution here is, don’t get surprised by the higher rate of interest they are charging.

This is because they are charging a premium for the risk they are taking by lending to borrowers like you having an unpleasant credit score.

In addition, in a few cases, they might not sanction the complete amount for which you applied.

What makes these loans ideal for you?

The good part about such loans is that you can get the loan amount is usually a maximum of one day and that too with minimum paperwork.

You have to compare lenders online and find the best deal consisting of additional benefits in the likes of details like processing fees, interest rate, collateral requirements, loan tenor etc.

Out of all the participants like private lenders, cooperative banks, NBFCs, P2P lenders, choose the best instant decision car finance company lending to bad credit borrowers.

You have to choose a lender with higher credibility and brand name. Before choosing the lender, confirm whether the rate of interest is fixed or floating, whether collateral is required or not, especially when you are making a down payment. Therefore, it is advisable to use a car loan comparison websites to get the best deal before purchasing your favourite car.

Another factor which you should consider is, do not select a lender whose monthly instalment is more than 40-45% of your monthly salary. Calculate the instalment using the free online calculator in advance to know the monthly instalment and whether or not you can afford it.

Also, volunteer to make an upfront down payment to reduce the outgo of interest payment and processing fees. Some of the bad credit car loan providers in the UK are Moneybarn, Safe Money Loan Stoneacre, Pegasus, Money Expert etc. These bad credit specialists take your current situation and affordability of finance into account to decide whether to lend you or not. They might also finance your car even if you have experienced bankruptcy in the past.

Conclusion

We hope this blog gave you valuable insights on how to finance your new car. The bottom line is you can get car finance even when your credit score is below the acceptable standards. So what is stopping you from driving your dream car, applying for this loan and taking your loved one on a romantic drive?

Lisa Ann has developed a well-experienced professional career. From managing the staff of more than 50+ loan experts at Fastmoneyfinance to boosting the delivery of various loan offers, she has acquired many challenging roles to come out with the best results for the company. Lisa Ann is a Senior Content Author and the Chief Financial Advisor at Fastmoneyfinance. To back her massive experience in the UK’s financial industry, she has the postgraduate degree and diploma in Business and Finance.